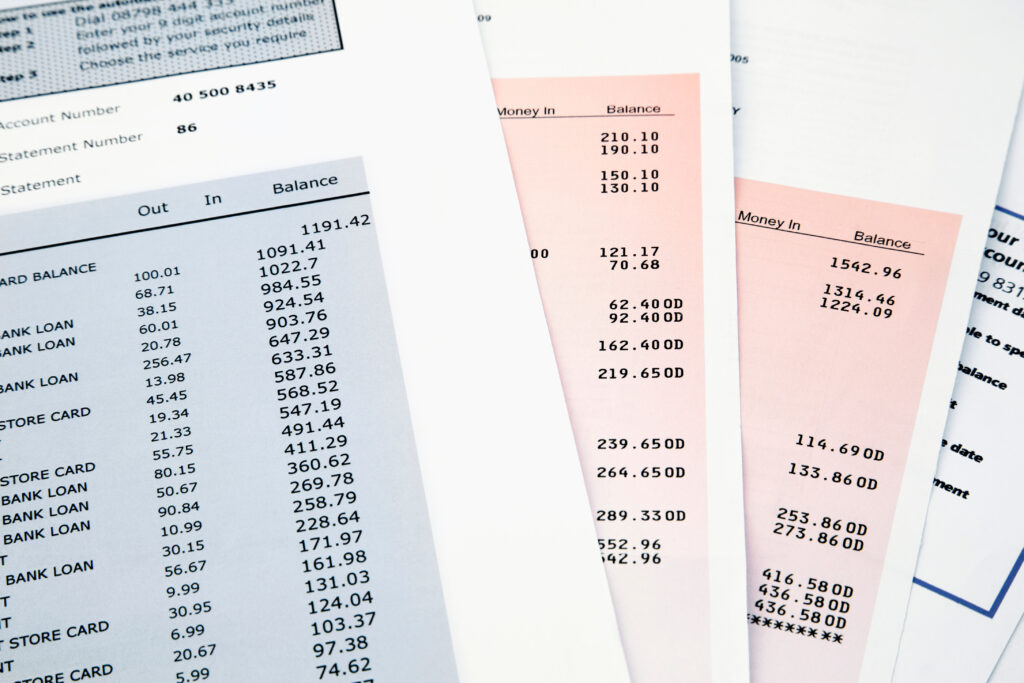

A Bank Statement Mortgage, also known as a Bank Statement Loan or a Self-Employed Mortgage, is a type of home loan designed for borrowers who have non-traditional or fluctuating income sources, such as self-employed individuals or business owners. Instead of relying on standard income documentation like W-2 forms or tax returns, these mortgages consider the borrower’s bank statements as proof of income. Here’s a brief description of a Bank Statement Mortgage:

1. **Income Verification:** In a Bank Statement Mortgage, the lender uses the borrower’s personal or business bank statements to verify their income and determine their ability to repay the loan. This approach is particularly beneficial for self-employed borrowers who may have income that varies from month to month.

2. **Flexible Documentation:** Unlike traditional mortgages that require detailed tax returns and income documentation, Bank Statement Mortgages are more lenient. Borrowers can use their bank statements as evidence of income without providing extensive paperwork.

3. **Income Sources:** Bank Statement Mortgages are suitable for borrowers with various income sources, including self-employment income, rental income, investments, or business income. It allows borrowers to use these sources effectively to qualify for a loan.

4. **Minimum Requirements:** Lenders typically require a minimum number of recent bank statements, often ranging from 12 to 24 months, to evaluate income stability and consistency.

5. **Higher Interest Rates:** Bank Statement Mortgages may come with slightly higher interest rates or additional fees compared to conventional loans. Lenders may charge higher rates to offset the perceived risk associated with reduced income documentation.

6. **Down Payment:** Borrowers may be required to make a larger down payment compared to traditional mortgages, typically ranging from 10% to 20% or more, depending on the lender’s policies and the borrower’s credit profile.

7. **Credit Score:** While credit score requirements vary by lender, borrowers may need a stronger credit history to qualify for a Bank Statement Mortgage, as it helps mitigate the lender’s risk.

8. **Loan Types:** Bank Statement Mortgages can be available as fixed-rate or adjustable-rate loans, offering borrowers some flexibility in choosing their preferred interest rate structure.

9. **Jumbo Loans:** These mortgages can also be used for jumbo loans, which are home loans that exceed the conventional loan limits set by government-sponsored entities like Fannie Mae and Freddie Mac.

10. **Documentation:** While Bank Statement Mortgages require less traditional income documentation, borrowers are still required to provide their bank statements and other financial documentation to support their loan application.

Bank Statement Mortgages cater to borrowers with unique income situations and offer an alternative to traditional mortgage options. However, due to the potential for higher interest rates and down payment requirements, borrowers should carefully assess their financial situation and explore other mortgage options before choosing a Bank Statement Mortgage. Working with a knowledgeable lender experienced in these types of loans is crucial to a successful application process.